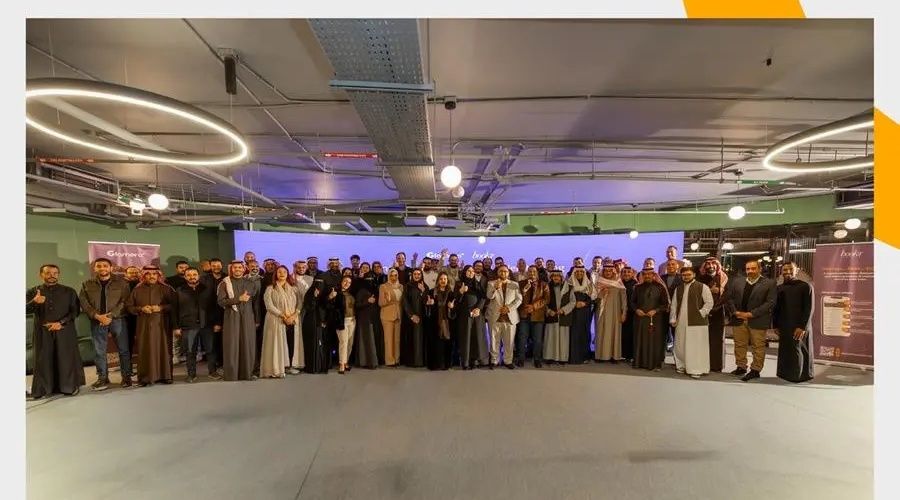

Glamera moves to acquire Bookr as it scales lifestyle tech platform in GCC

Glamera Buys Kuwait’s Bookr to Dominate Beauty Tech

MENA Signal • January 31, 2026

Saudi platform Glamera acquired Kuwaiti booking rival Bookr for an undisclosed sum. This move consolidates two major players in the GCC beauty and wellness tech sector. Glamera contributes SAR 4 billion in processed transactions and 4,500 service providers to the deal. Meanwhile, Bookr brings 300,000 users across Kuwait, Bahrain, and Saudi. The combined entity aims to create a unified, AI-powered ecosystem for the region.

Why MENA Founders Should Care

You need massive transactional volume to attract capital today. Glamera’s SAR 4 billion in processed transactions sets a brutal new standard. Investors are no longer funding user growth; they fund proven financial throughput. If your platform isn't moving significant capital, you won't raise a Series A. The era of vanity metrics is officially over. You must show clear transactional value or you will likely shut down. Founders must prioritize revenue over user counts immediately. If you don't have the numbers, you don't get the check.

The market is aggressively squeezing out smaller independent players. This acquisition proves that regional players must merge to survive the slowdown. You cannot operate as a small, local startup for much longer. Competitors with better scale and funding will either crush you or buy you out. The "land and expand" strategy is quickly becoming "buy and dominate." Fragmentation is now a liability, not an asset. You must consolidate or exit before capital runs dry. Standing still is not an option.

Founders should build for specific GCC markets to get acquired. Glamera needed Bookr’s strong foothold in Kuwait and Bahrain. You can build real value by dominating a niche geography or vertical. Strategic buyers are actively looking for established operational data, not just ideas. This creates a clear, lucrative exit route for local operators. Focus on execution in your local market and position yourself as a target. Do not try to be the regional giant yourself. Build to sell.

The Context

Glamera launched in 2022 and scaled rapidly to support over 4,500 providers. Bookr started in 2018 and built a loyal user base in Kuwait and Bahrain. This acquisition fits a wider pattern of Saudi firms buying regional tech assets. It reflects the Kingdom's strategic push to become a digital hub. The beauty sector is seeing rapid digital adoption, driving demand for booking software. This merger sets the stage for Glamera's future public listing. It shows how quickly newer startups can absorb older players. The market rewards speed and operational efficiency now.

🌶️ Spicy Take

Merging is the only survival strategy for mid-market SaaS startups today. Standalone beauty apps without massive scale are dead on arrival.

What's Next

Watch for Glamera's IPO roadmap announcement later this year. Expect Saudi firms to snap up more GCC SaaS assets.

Written for founders building in the Middle East and North Africa